LONDON (Oct 10) — Tech giant Google might soon have to go with another way of doing business in the UK after having been successfully designated as the first under the new rules which curb Big Tech dominance.

As part of the UK’s digital economy, the Competition and Markets Authority (CMA) has now elevated Google’s search business to the status of “strategic market status” (SMS). Thus, the regulator has a relatively wide authority to set fair competition and transparency parameters.

“The CMA has decided that Google maintains a strategic position in the search and search advertising sector with over 90 percent of the searches in the UK conducted on its platform,” explained Will Hayter, CMA Executive Director for Digital Markets.

Meaning Behind the CMA’s Ruling

While the decision itself doesn’t accuse Google of any wrongdoing, it empowers the CMA itself to intervene at times of great market imbalance, impose penalties for breaches, and call for operational changes.

Potential interventions include the following — previously raised for consideration back in June:

- Ranking competitors fairly in search results

- Making it easy for users to access alternative search engines

- Giving publishers and content producers more power and rights over the use of their work in AI-generated search responses

The CMA sees consultation on specific measures later this year, which will be followed by setting of final requirements.

Google Pushes Back

Google has defended its position, adding that excessive regulation would hinder innovation and delay product roll-outs in the UK.

“Most of the ideas raised would inhibit UK innovation and growth, possibly slowing product launches at a time of great AI-driven innovation,” said Oliver Bethell, Google’s Senior Director for Competition.

The firm recently committed to invest £5billion ($6.65 billion) in Britain, making it clear that this was to point out its unwavering commitment to the UK, notwithstanding regulatory hurdles.

The Beginning of a New Era in Technical Oversight

This is the first major application by the CMA of its powers to control Big Tech. Investigation into mobile operating systems, in particular Android, could lead to other restrictions on Google.

At the same time, Google is also facing more scrutiny worldwide:

- The U.S. Federal Trade Commission is investigating search advertising practices in concert with Amazon.

- The U.S. Department of Justice is pushing to force Google to divest some ad-tech assets.

- Recently, the European Union fined Google $3.45 billion for anti-competitive behavior in its advertising business.

These coordinated efforts signal a broader international push to rebalance power in digital markets.

Impact on Consumers and Publishers

Experts see that the CMA’s move could empower publishers and smaller tech players alike, putting them in a stronger position for deciding how their data and content would be utilized in any training AI.

Tom Smith, who was a director at the CMA and is now a competition lawyer at Geradin Partners, said the reduction of Google’s dominance could clear long-held distortions in the market.

“Giving control to website operators regarding how their content is used for AI training would help level the playing field and diminish Google’s unfair predominance,” Smith stated.

CMA confirmed that at present, Google’s Gemini AI assistant does not stand within the ambit of its designation. In contrast, other AI-based functionalities, including AI Overview and AI Mode, come under the ambit — a move signifying the first-ever attempt by the UK to govern the integration of AI with search results.

A Broad Push for Responsible AI and Search Innovation

The UK government has encouraged the CMA to trade-off competition versus economic growth, stressing innovation while keeping a clear regulatory pathway for businesses.

With more watchful eyes from regulators worldwide, the results of this case could set the benchmark for how countries oversee AI search engines and advertising dominance for the next decade.

❓ FAQs

Q1: Why is Google coming under fresh regulation in the UK?

The UK Competition and Markets Authority (CMA) has classified Google as holding strategic market status, thereby enabling regulators to oversee its dominance in search and advertising.

Q2: What changes could possibly be imposed on Google?

Measures could include fairer ranking of search results; creating a simpler process for switching to rival search engines; and granting more control to publishers over AI-generated content.

Q3: Does this mean that Google broke UK law?

No. The CMA has clarified this is not a finding of any wrongdoing; rather, it is a way to protect competition in the digital economy.

Q4: How might this bear upon other tech companies?

The ruling sets a precedent for regulating other tech giants such as Amazon, Apple, and Meta, especially in the fields of AI, mobile operating systems, and advertising markets.

Q5: What has been Google’s position on the ruling?

Google said stricter overseeing might hamper innovation and harm product development in the UK. The company continues its engagement with the regulator.

Q6: How does this fit with global inquiries?

Google has also faced antitrust investigations in the U.S. and EU into its ad-tech business. This UK ruling further adds pressure to Google's global regulatory outlook.

Google faces tighter regulation in UK over search dominance | Picture uploaded on

Google faces tighter regulation in UK over search dominance | Picture uploaded on

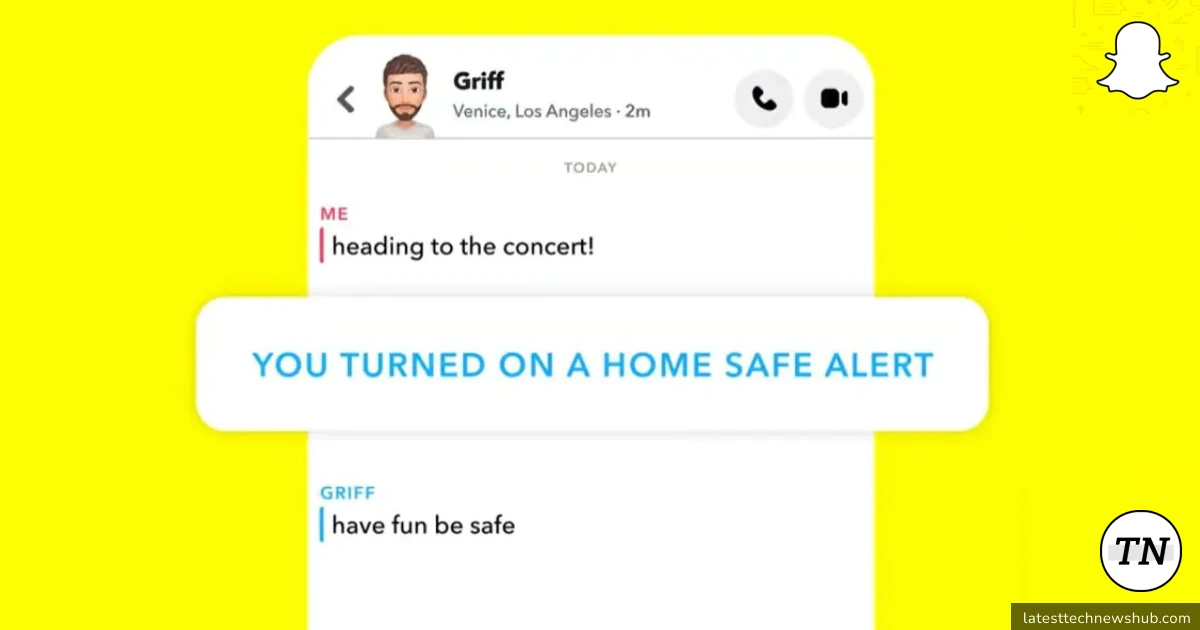

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on  Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on

Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on  Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

2 thoughts on “Snapchat now lets you inform others when you have arrived at your destination”

Comments are closed.