SEOUL (Oct. 14) — Samsung Electronics was expected to record the strongest quarterly profit in over three years, led by strong demand in memory chips across the globe and by the AI boom, which will consequently affect commodity chips to be in tight supply, pushing prices high.

The South Korean tech giant also expected an operating profit of 12.1 trillion won ($8.5 billion) for the July–September period, up 32% on a yearly basis and better than the expected analyst figure of 10.1 trillion won as compiled by LSEG SmartEstimate. The result is a notch back to one of Samsung’s finest for this quarter in the last 13 and a signal of the semiconductor market that has a strong foundation to return.

AI Throws Out Some Cork in the Memory Ocean of Recovery

In that respect, while lagging in its effort to capture a chunk of the high-bandwidth memory market clients (by selling HBM chips to Nvidia, for instance), Samsung’s strong showing in conventional DRAM and NAND memory markets might have fueled the loss-making AI chip sales.

“The earnings surprise came from the chip business,” said Ryu Young-ho, senior analyst at NH Investment & Securities. “Strong demand for conventional memory to support general-purpose servers, combined with robust HBM demand for AI servers, has fueled overall memory demand.”

Samsung’s dominance has been largely drawn from its memory chip-making, which has stayed the longest in the world, as some of the closest constraints haven’t hampered the supply-export scenario with such good fortune. DRAM chips — which have been widely used in servers, smartphones, and PCs — were up by over 170% in price from a year earlier yield, according to TrendForce.

Increasing Revenue with Pricing Power

Sales in the quarter rose by 8.7% to 86 trillion won, an all-time high since it benefited from a weakening won and higher chip prices. Analysts said the Samsung Foundry division managed to cut losses during the period by becoming more profitable, which helped the overall business.

“Samsung is a major beneficiary of the growing demand for commodity chips,” said Sohn In-joon from Heungkuk Securities, pointing out that lower inventories and stronger DRAM and NAND prices have given the company more bargaining power.

The company is expected to release detailed earnings on October 30.

AI Boom Tightens Memory Chip Supplies

AI infrastructure — including servers and data centers — that are being built out across the globe is essentially choking the supplies of traditional memory chips, which have thus faced lengthy periods of scarcity through 2026, during which memory chip prices are likely to rise.

Many chipmakers involved themselves in producing advanced AI hardware, thereby squeezing the supply of regular memory. Analysts anticipate the shortages in the commodity memory through 2026 by rapidly accelerating AI-related upgrades and will continue to cause similar conditions in other major tech firms.

Samsung has recently secured various supply contracts involving Tesla and OpenAI which suggest that it might be focused on AI applications. However, potential trade tensions between the US and China, export restrictions, and other hikes on tariff barriers could spoil its ambition in consumer electronics and its chip exports in the impending quarters.

AI Ambitions and Future Outlook for Samsung

While Samsung surrendered its global No. 1 DRAM market share to SK Hynix this year, a gradual recovery is expected to resume when it presents the bulk production of HBM3E chips and get set to develop HBM4 for 2026, as analysts project.

“Samsung is on track with next-generation HBM4 development, working closely with major U.S. partners,” Morgan Stanley noted in a recent report.

To further encourage employees, the company plans to launch a performance-based share compensation program for all its employees across South Korea over the next three years, according to a recent internal memorandum.

Amid fierce market competition, analysts seem confident that Samsung has the right ingredients in its mix, such as AI-driven innovation, careful supply discipline, and strategic R&D investment, to hit a bulls-eye in the memory market.

Outlook

In conclusion, Samsung performance in the third quarter represents the balancing act between AI and the recovery in the traditional chip market. Hence, the future balancing token for AI chips and memory chip production will be the location of the fight for the halfway house shaping the next decade conjoined with semiconductor technology.

❓ FAQs

Q1: Why is Samsung reporting its highest profit since 2022?

Profit rose sharply as demand from end users to increase the prices of conventional memory chips derived from the rising trend in the development of AI infrastructure and data centers around the world.

Q2: How much profit did Samsung earn in the third quarter?

The expected operating profit of the company for the period between July and September is about 12.1 trillion won, or roughly $8.5 billion, marking the best quarterly performance in more than three years.

Q3: What causes the global chip shortages?

While manufacturers chase after AI and high-output chips, production of conventional memory chips has, however, slowed down, tightening supply and lifting prices.

Q4: How does Samsung compete in AI chip technology?

Samsung is vigorously stepping up its production of HBM3E and next generation HBM4 chips with an aim to par the gap between itself and SK Hynix while further strengthening partnerships with American counterparts like Nvidia.

Q5: What risks could hinder Samsung's growth?

Analysts conjecture that along with U.S.-China trade tensions, export controls, and competition in the AI market, the aforementioned factors could hinder or inhibit Samsung's future earnings and operations.

Samsung Expects Strongest Profit Since 2022 as AI Demand Tightens Memory Chip Supply | Picture uploaded on

Samsung Expects Strongest Profit Since 2022 as AI Demand Tightens Memory Chip Supply | Picture uploaded on

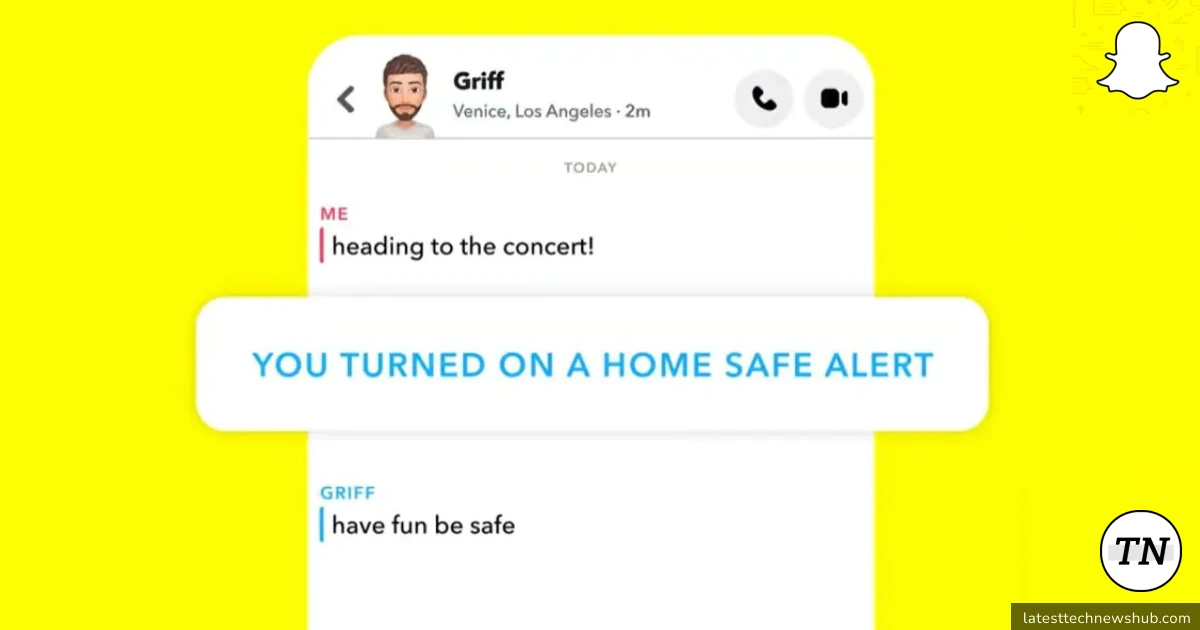

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on  Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on

Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on  Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

2 thoughts on “Snapchat now lets you inform others when you have arrived at your destination”

Comments are closed.