Artificial intelligence is transforming workplaces — but not necessarily to the benefit of employees. Recent research by the British Standards Institution (BSI) shows that companies are turning to AI not just to fill gaps in skills, but also with an eye towards employee reduction and cost-cutting. Entry-level positions are particularly targeted.

The report, titled “Evolving Together: Flourishing in the AI Workforce,” analyzed corporate annual reports and duly conducted a survey of over 850 business leaders across different industries. It brought to light a very striking trend: Almost two-thirds of organizations are intending to ramp up their AI investments within the next 12 months, but much of that spending appears to be directed toward automation rather than upskilling.

AI Priorities: Efficiency Over Employment

More than 40% of executives admitted that AI is already being used to facilitate staff reductions, while one in three said they now look to AI solutions before hiring new employees.

Even more worrying, a quarter of respondents believe that most entry-level tasks could be tackled by AI just as effectively — if not better — than a human worker. As the adoption spreads, the “unit cost” of AI-driven tasks keeps going down, thus providing a stronger economic incentive for AI to be used as a substitute for human labor.

Large Corporations Lead the Shift

AI adoption is ramping up more quickly among large corporations than amidst small ones.

Close to 70% of big-business leaders view AI as the linchpin for future growth, whereas half of SMEs share this sentiment.

Some companies marry automation to upskilling: Banco Santander, for example, will train all staff in AI by 2026. Meanwhile, the UK’s Financial Conduct Authority (FCA) unveiled its “supercharged sandbox” — a protected testing zone that enables financial firms to tinker with AI applications using Nvidia’s high-performance computing resources.

Overall, however, the landscape appears to be one of workforce attrition: 50% of large organizations have already eliminated junior roles through AI, up from 30% for SMEs. Many expect further reductions in the coming years.

Mixed Signals Across the Atlantic

Interestingly, this enthusiasm contrasts with data from the U.S. Census Bureau showing that many American corporations are putting the brakes on their AI investments after mixed results. Yet, automation seems to be gathering unstoppable momentum across the UK and Europe.

A Workforce at Risk of “Deskilling”

Almost half of leaders surveyed (49%) admitted that had AI tools existed when they started their careers, they would not have developed the same skills that led to their current positions. Over 50% said they feel “lucky” to have started their careers before the AI boom.

This raises an anxiety: while AI furthers efficiency, it may undermine the fundamental skill sets that will make future executives succeed — thereby putting a long-term talent gap in place, even as short-term productivity wins.

The Hidden Risks of Automation

The haste to automate can lead to terrible consequences as well. AI models operate via the method of pattern recognition. When the variables start becoming too many, that is when they tend to fail.

For example, a Home Office project using AI to assist with processing asylum applications had major inaccuracies, raising further concerns about algorithmic bias and oversight in the public service.

Conclusion

The BSI finding has ugly truths to reveal: AI may just be redefining the future of work faster than business and employees can hope to adjust. Although automation promises efficiency and savings, it also appears to be wiping out entry-level opportunities and closing down avenues for skills development.

For work environments to truly “flourish in the AI workforce,” as the report asserts, an even balance must be struck: AI should augment employees, not replace them, by creating smarter education and ethical practices together with human-centered innovation. Learn more how AI changing the world at our AI & Machine Learning Section.

❓ FAQs

Q1: Why is AI mostly impacting entry-level jobs?

Entry-level jobs are one of the few jobs that are mostly repetitive or do not necessarily need advanced training. AI finds its best faculties in these areas. As these tools are gaining momentum and the costs are falling, businesses are replacing these jobs with an aim to cut costs and increase efficiency.

Q2: How is AI managing workforce changes for the organizations?

Most of the organizations today are using AI for data, customer support, and administrative jobs. They prefer these tools for automating the processes rather than creating new hirees or restructuring their teams based on AI operational processes.

Q3: Are the big companies AI-friendlier compared to the SMEs?

Yes. According to the research done by BSI, close to 70% of the big companies consider AI their backbone for growth as against about 51% of the SMEs. The bigger companies have better access to resources for AI implementation and testing.

Q4: Will AI take away some jobs from humans completely?

In reality, AI handles some routine jobs rather effectively; however, it does not yet possess emotional intelligence, creativity, or ethical judgment. Analysts are of the opinion that AI will modify rather than entirely replace most jobs through the creation of hybrid ones where technical and human skills converge.

Q5: What dangers come with being overly reliant on AI automation?

Errors, bias, and "deskilling" from over-reliance on AI are things employees will have to contend with; losing the opportunity to cultivate critical-thinking and problem-solving skills shrink the gap between workers who can adjust to AI and those who cannot.

Q6: How do organizations balance between AI adoption and human development?

Companies should invest in continual skill development of their teams while responsibly implementing AI tools. The essence of automation is to be enabling for human ability, not disabling, for the long-term benefit of innovation and stability of the workforce.

AI-Led Automation Is Rapidly Replacing Entry-Level Jobs, Warns BSI | Picture uploaded on

AI-Led Automation Is Rapidly Replacing Entry-Level Jobs, Warns BSI | Picture uploaded on

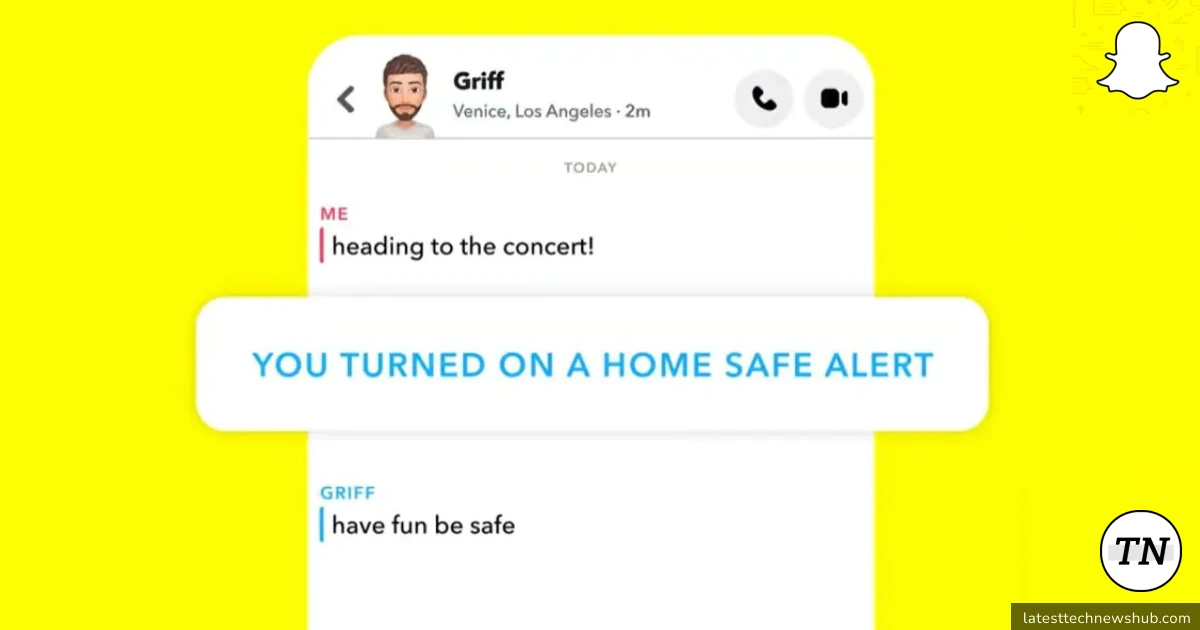

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on  Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on

Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on  Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

2 thoughts on “AI-Led Automation Is Rapidly Replacing Entry-Level Jobs, Warns BSI”

Comments are closed.