HONG KONG/BEIJING (October 10) – The Chinese humanoid robot developer AgiBot, several sources privy to the plan said, is preparing to launch an initial public offering (IPO) in Hong Kong next year for a valuation between HK$40 billion and HK$50 billion (approximately $5.1–6.4 billion).

With principal backers that include Tencent and HongShan Capital Group (HSG), the Shanghai-based establishment plans to file its preliminary prospectus in early 2025 and, if all goes well, would debut on the public market by the third quarter of 2026.

The IPO, first reported by Reuters, would be one of the most ambitious listings from China’s budding robotics sector—a sector that Beijing considers critical in rejuvenating its aging workforce and advancing national automation goals.

AgiBot’s Expansion and Investment Partners

AgiBot was founded in 2023 by former Huawei engineers Deng Taihua and Peng Zhihui. It became a newsworthy company earlier this year when President Xi Jinping inspected its humanoid robots during a visit to Shanghai.

The company manufactures two main models of robots—Yuanzheng and Lingxi—and data collection systems for AI model training. Their technology can perform tasks in the real world, such as folding clothes, brewing coffee, and cleaning facilities, all to the end of improving operational efficiency for industries and cutting labor costs.

In August of 2025, AgiBot announced a multi-million yuan partnership with Fulin Precision Engineering, to deploy some 100 Yuanzheng robots across its manufacturing plants. At the same time, the firm wound up strategic funding featuring LG Electronics, Mirae Asset, BYD, and Hillhouse Investment, per regulatory filings.

IPO Details and Market Outlook

For its Hong Kong listing, AgiBot has named China International Capital Corp (CICC) and CITIC Securities as joint sponsors, with the addition of Morgan Stanley in recent weeks.

In the offering, according to one source, it is estimated that the company will dispose of 15%–25% of its shares. But issues like timeline, pricing, and valuation remain to be determined, subject to market conditions.

AgiBot was valued at $2.07 billion as of March 2025, according to PitchBook data.

China’s Robotics Boom

With the emergence of new startups and tech giants, China’s humanoid robotics industry is heating up real fast. This upcoming IPO of AgiBot will be following the path of Ubtech Robotics, the first humanoid robot company ever listed in Hong Kong in late 2023; Ubtech has since gained 150% in 2025 and significantly outperformed Hang Seng Index, which registered a paltry 32% gain.

The competing Unitree Robotics is reportedly preparing to debut on the Shanghai STAR Market for a valuation as high as 50 billion yuan ($7 billion).

It has now been reported by the London Stock Exchange Group (LSEG) that Hong Kong has overtaken New York as the world’s premier IPO hub by total volume of listings and secondary offerings in 2023. So far, more than 270 companies have filed to list in the city and have raised almost $24 billion in 2025, more than double what has been raised in 2024.

What’s Next for AgiBot

With strong government support, international investors, and an unprecedented global demand for humanoid automation, this IPO of AgiBot may set the new benchmark for China’s AI-centric robotics industry.

If successful, it will entrench Hong Kong as the de facto market for the next generation of tech innovation across China-from humanoid robots to advanced AI automation systems reshaping the future of work.

❓ FAQs

Q1: What type of company is AgiBot?

AgiBot is a Chinese robotics company that designs and manufactures humanoid robots along with AI-based automation systems that operate for industries such as manufacturing and logistics.

Q2: When will AgiBot's IPO take place?

The company plans to submit its IPO prospectus in early 2025 and switch to the Hong Kong Stock Exchange in the third quarter of 2026, market conditions permitting.

Q3: How much money is AgiBot's IPO projected to raise?

According to sources, an estimated valuation of HK$40 to 50 billion—which is equivalent to approximately USD$5.1 to6.4 billion—would qualify as one of the largest IPOs in the sector of humanoid robotics.

Q4: Who are the main investors of AgiBot?

Some of the big names backing the company include Tencent, HongShan Capital, LG Electronics, Mirae Asset, BYD, and Hillhouse Investment.

Q5: What is AgiBot's work?

AgiBot's major humanoid robot models are Yuanzheng and Lingxi, which can carry out daily and industrial activities such as folding garments, making coffee, and cleaning.

Q6: How does AgiBot's IPO relate to China's AI and robotics boom?

It highlights the increasing focus of China on AI-led automation and robotics innovation, a growing trend supported by government policies to mitigate the aging society and labor shortage.

Chinese Robot Maker AgiBot Eyes 6 Billion Hong Kong IPO in 2026 | Picture uploaded on

Chinese Robot Maker AgiBot Eyes 6 Billion Hong Kong IPO in 2026 | Picture uploaded on

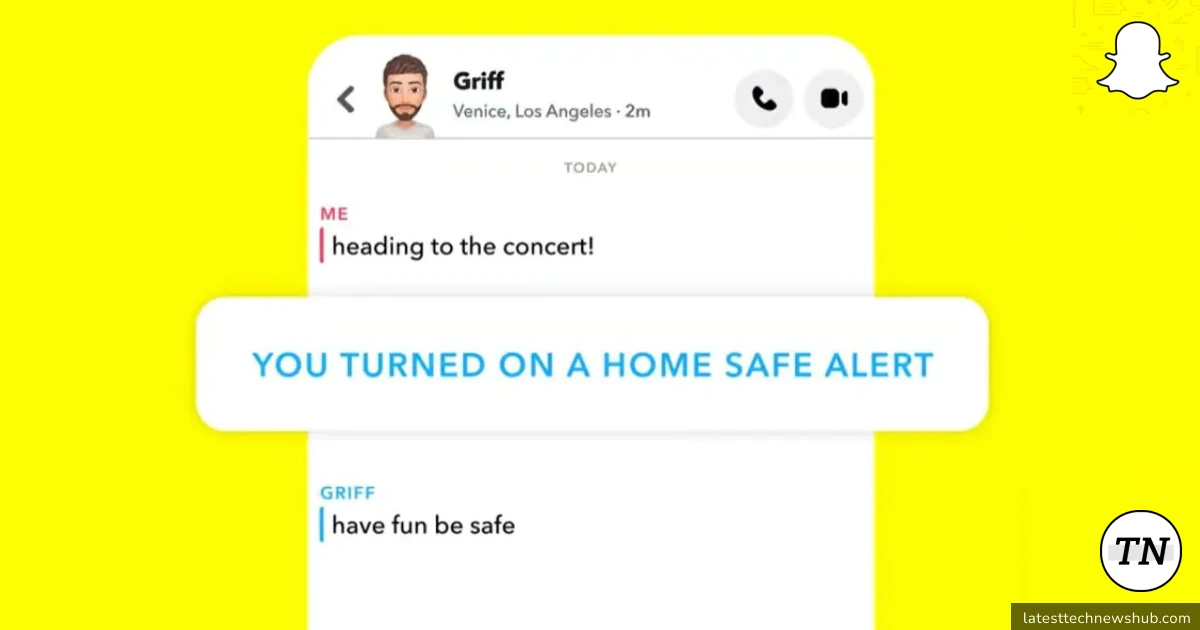

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on

Snapchat now lets you inform others when you have arrived at your destination | Picture uploaded on  Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on

Instagram, YouTube addiction trial kicks off in Los Angeles | Picture uploaded on  Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

Snap forecasts quarterly revenue below estimates as ad competition hurts | Picture uploaded on

1 thought on “Chinese Robot Maker AgiBot Eyes $6 Billion Hong Kong IPO in 2026”

Comments are closed.